Order matching tools are fundamental to modern financial markets, enabling the efficient execution of trades. They essentially act as the core mechanism of an exchange, bringing together buyers and sellers to facilitate transactions.

What is Order Matching?

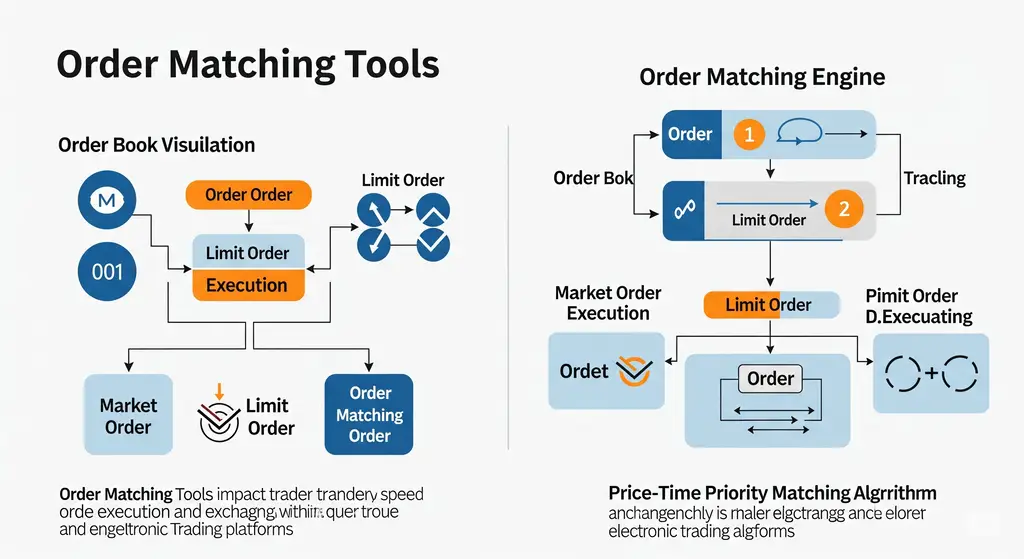

At its most basic, order matching is the process by which buy and sell orders are paired up and executed. When a trader places an order (e.g., to buy 100 shares of XYZ at $50), this order enters an order book. The order matching system then continuously searches for a corresponding counter-order (e.g., a sell order for 100 shares of XYZ at $50 or less).

How Do Order Matching Tools Work?

Order matching tools, often part of an exchange’s matching engine, operate based on a set of predefined rules, primarily price-time priority:

- Price Priority: Orders with the best price are prioritized. For buy orders, this means the highest bid; for sell orders, it means the lowest ask.

- Time Priority: If multiple orders exist at the same best price, the order that was placed first (i.e., entered the order book earliest) will be executed first.

Beyond these core rules, more complex order types and matching algorithms exist to handle various trading strategies, such as:

- Market Orders: Executed immediately at the best available price.

- Limit Orders: Executed only at a specified price or better.

- Stop Orders: Triggered when a certain price is reached, converting into a market or limit order.

- Iceberg Orders: Large orders broken down into smaller, visible components to avoid market impact.

Key Components of Order Matching Tools

- Order Book: This is a real-time list of all outstanding buy and sell orders for a particular financial instrument, organized by price level. It provides transparency into market depth and liquidity.

- Matching Engine: The software system that processes incoming orders, applies the matching rules, and executes trades. It’s designed for speed and efficiency, especially in high-frequency trading environments.

- Connectivity: Seamless integration with brokers, trading platforms, and market data providers is crucial for efficient order flow.

Importance in Trading

Order matching tools are vital for:

- Liquidity: By facilitating continuous matching, they ensure that there are always buyers and sellers, promoting a liquid market.

- Fairness and Transparency: Price-time priority ensures that all participants have an equal opportunity to have their orders filled, fostering a fair trading environment. The order book provides transparency into market supply and demand.

- Efficiency: Automated matching allows for rapid execution of trades, which is essential in fast-moving markets.

- Price Discovery: The interaction of buy and sell orders in the order book helps in the continuous discovery of market prices.

In essence, understanding order matching tools is crucial for any trader looking to grasp the mechanics of how their orders are processed and executed in the financial markets.