Introduction

Market trends have always captivated investors, from seasoned traders to passive participants. Understanding the dynamics of bull and bear cycles is essential for anyone looking to make informed decisions in trading or investing. In this article, we will delve into the definitions, characteristics, and psychological aspects of bull and bear markets. We will analyze historical trends, key indicators, and strategies for navigating these cycles effectively, all aimed at equipping you with the knowledge necessary to thrive in any market condition.

Market Trends: Analyzing Bull and Bear Cycles

Understanding Bull and Bear Markets

What is a Bull Market?

A bull market is characterized by rising asset prices, typically marked by an increase of 20% or more in market indexes. Bull markets usually occur when the economic outlook is positive. Investors’ confidence thrives, leading to heightened trading activity and growth across sectors. Here are some defining features of bull markets:

- Rising Prices: Sustained increases in asset prices.

- Economic Growth: Strong performance indicators, including GDP and employment rates.

- Favorable Market Conditions: Low-interest rates and positive corporate earning reports.

What is a Bear Market?

Conversely, a bear market represents a downward trend, indicated by a decline of 20% or more in market indexes. Generally, bear markets emerge during economic downturns. Investor confidence wanes, leading to selling pressure and decreased market activity. Key attributes of bear markets include:

- Declining Prices: Prolonged decreases in asset prices.

- Economic Recession: Negative GDP growth and high unemployment rates.

- Unfavorable Market Conditions: Rising interest rates and negative earnings outlook.

The Psychology Behind Market Cycles

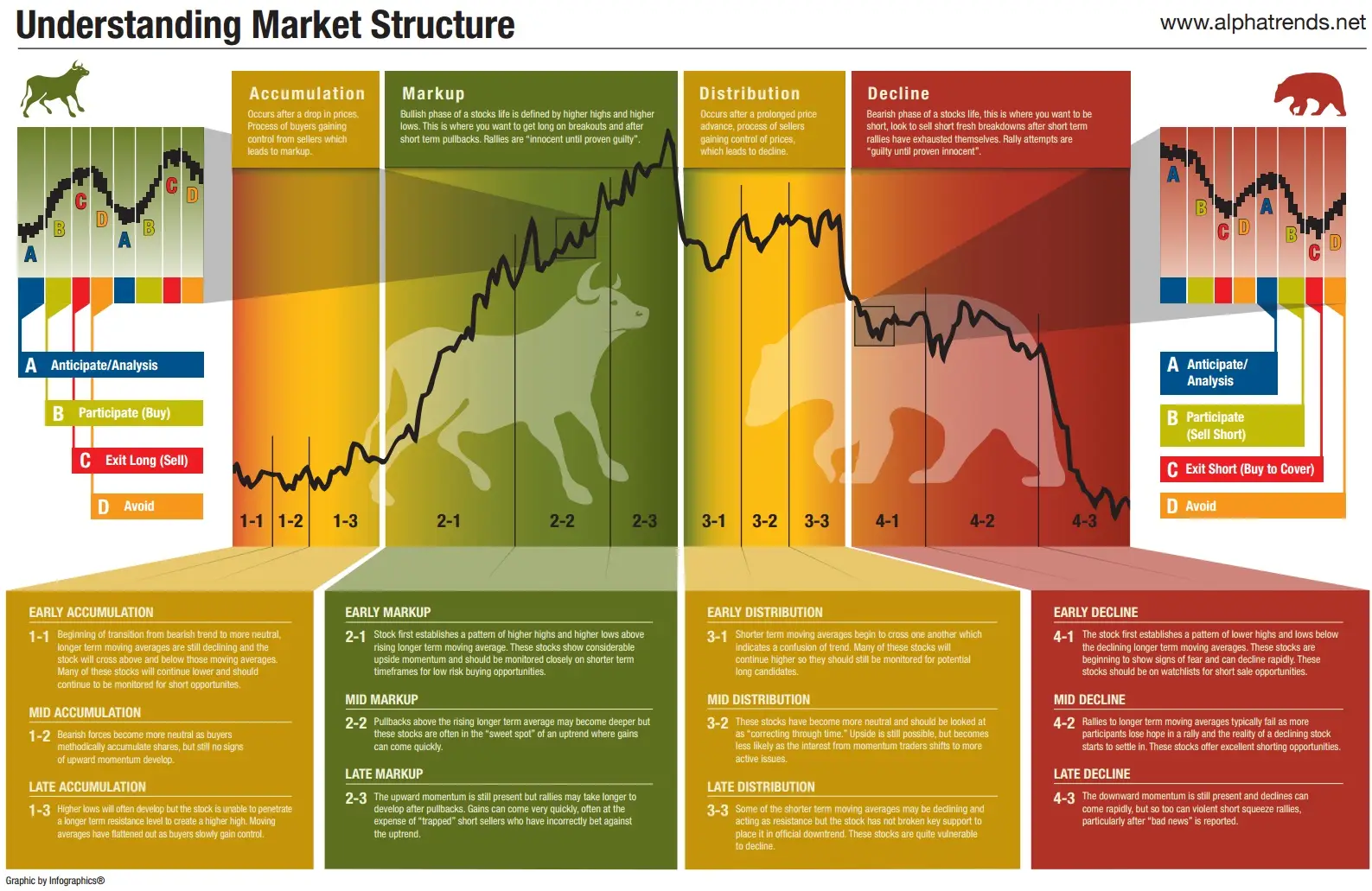

Delving into market psychology helps us understand the emotional responses of investors during different market conditions. The phases can be illustrated in the following market cycle:

- Euphoria: In the bullish phase, optimism leads traders to believe that prices will continue to rise indefinitely.

- Anxiety: As the market reaches a peak, concerns may arise about stability, prompting some investors to take profits.

- Panic: In the bearish phase, fear drives investors to liquidate positions rapidly, often resulting in significant losses.

- Despair: At the bear market’s low, many investors feel hopeless, and some exit the market entirely.

- Hope: Initial signs of recovery spark optimism and renewed interest, leading to accumulation.

Historical Analysis of Bull and Bear Markets

The Great Depression (1929 – 1932)

The Great Depression period is one of the most intense bear markets in history. It saw the stock market from its peak in 1929 to a profound decline by 1932. The focus shifted from an optimistic post-war economy to drastic measures, including government interventions to stabilize. The features included:

- Massive unemployment rates peaking at 25%.

- Coupled with negative GDP growth exceeding -30% in 1932.

- Led to longstanding regulations in financial markets.

The Dot-Com Bubble (1990s – 2000)

Conversely, the late 1990s ushered in a tear of exponential growth in technology. Emerging internet-based companies led to an absolute bullish phase, with dramatic market highs commencing in 1999. Key observations were:

- The Nasdaq increased astronomically by nearly 400% from 1995 to 2000.

- Speculative investments dominated, leading to a massive bubble.

- The eventual bust resulted in a severe market correction and a bear market lasting until 2002.

The Global Financial Crisis (2007 – 2009)

The financial crisis painted a stark contrast between both market cycles, as the world transitioned from a substantial bull market, notably driven by real estate and mortgage-backed securities, into a bear market triggered by failures of financial institutions. Highlights included:

- Record housing prices followed by a collapse of market values.

- +40% of global wealth evaporated in just a few years.

- Resulted in strong regulations like the Dodd-Frank Act in the U.S.

The Pandemic Market Reaction (2020)

The COVID-19 pandemic introduced unprecedented volatility in both directions. From an all-time bull market high in February 2020 to a drastic decline in March, only to rally back to new heights by year-end. Important findings include:

- Rapid adoption of technology: Accelerated growth for sectors like e-commerce and remote working solutions.

- Government intervention: Stimulus packages significantly impacted consumer spending behavior.

- Market V-shaped recovery: Indicating recovery patterns often more robust than initially anticipated.

Indicators of Market Trends

Successful trading using bull and bear market phases heavily relies on understanding relevant indicators. Some principal indicators include:

Economic Indicators

- Gross Domestic Product (GDP): Reflects overall economic health; growth aligns with bull markets, while contraction indicates bear markets.

- Unemployment Rates: High employment rates suggest economic strength; increasing unemployment points towards downturns.

- Consumer Confidence Index (CCI): Gauges consumer willingness to spend; higher confidence correlates with bull market expansion.

Technical Indicators

- Moving Averages (MA): Commonly used to gauge trends; crosses in moving averages often signal transitional market phases.

- Relative Strength Index (RSI): Assesses overbought or oversold conditions; readings above 70 indicate a potential downturn, while below 30 signal potential recoveries.

Market Breadth Indicators

- Advance-Decline Line: Measures the number of advancing stocks against declining stocks; a widening gap indicates strength in market direction.

- High-Low Index: Tracks new highs and lows; significant disparities can indicate market phases.

Strategies for Navigating Bull and Bear Cycles

Bull Market Strategies

- Invest in Growth Assets: Stock-based investments tend to outperform in bullish conditions.

- Long-term Positions: Buy-and-hold strategies can harness compounding growth over time.

- Leverage: Using margin can enhance returns, though it carries high risk.

Bear Market Strategies

- Diversification: Spread investments across asset classes to reduce risk.

- Short Selling: Capitalize on declining prices; however, it requires a cautious approach.

- Defensive Investments: Focus on stable, non-cyclical stocks that can weather downturns.

- Invest in Bonds: Typically inversely correlated, bonds may provide stability during a downturn.

Conclusion

Understanding the nuances of bull and bear markets is imperative for navigating financial markets successfully. While market cycles may be unpredictable, using economic and technical indicators can help traders and investors position their portfolios effectively. By applying strategic methodologies and focusing on psychological norms, investors can manage risks and maximize gains, regardless of the economic landscape.

For further insights, resources, and tools, visit My Website.

References

- Economic and Financial Market Reports

- Historical Market Data and Trends

- Technical and Fundamental Analysis Guidelines

- Psychological Aspects of Investor Behavior