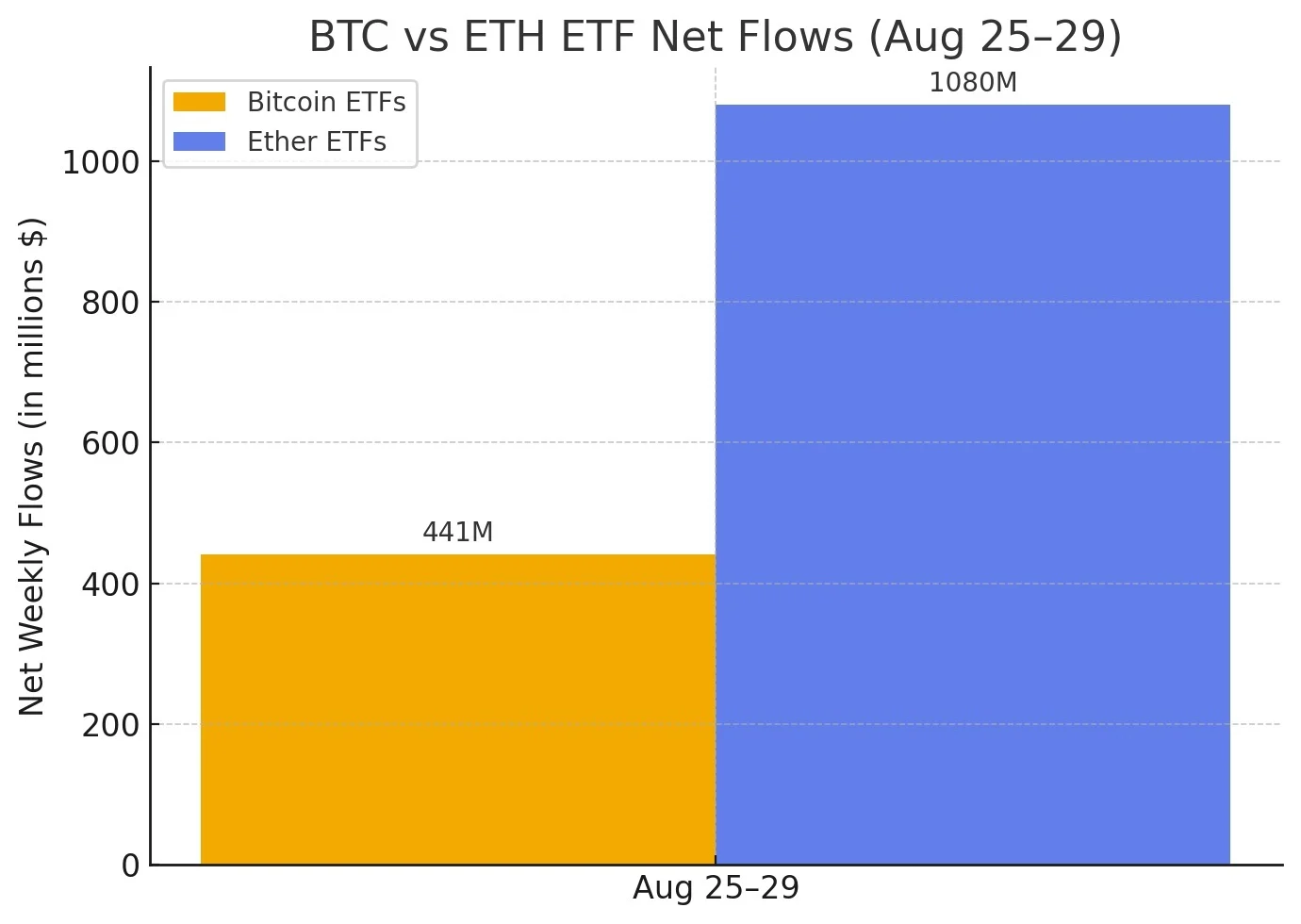

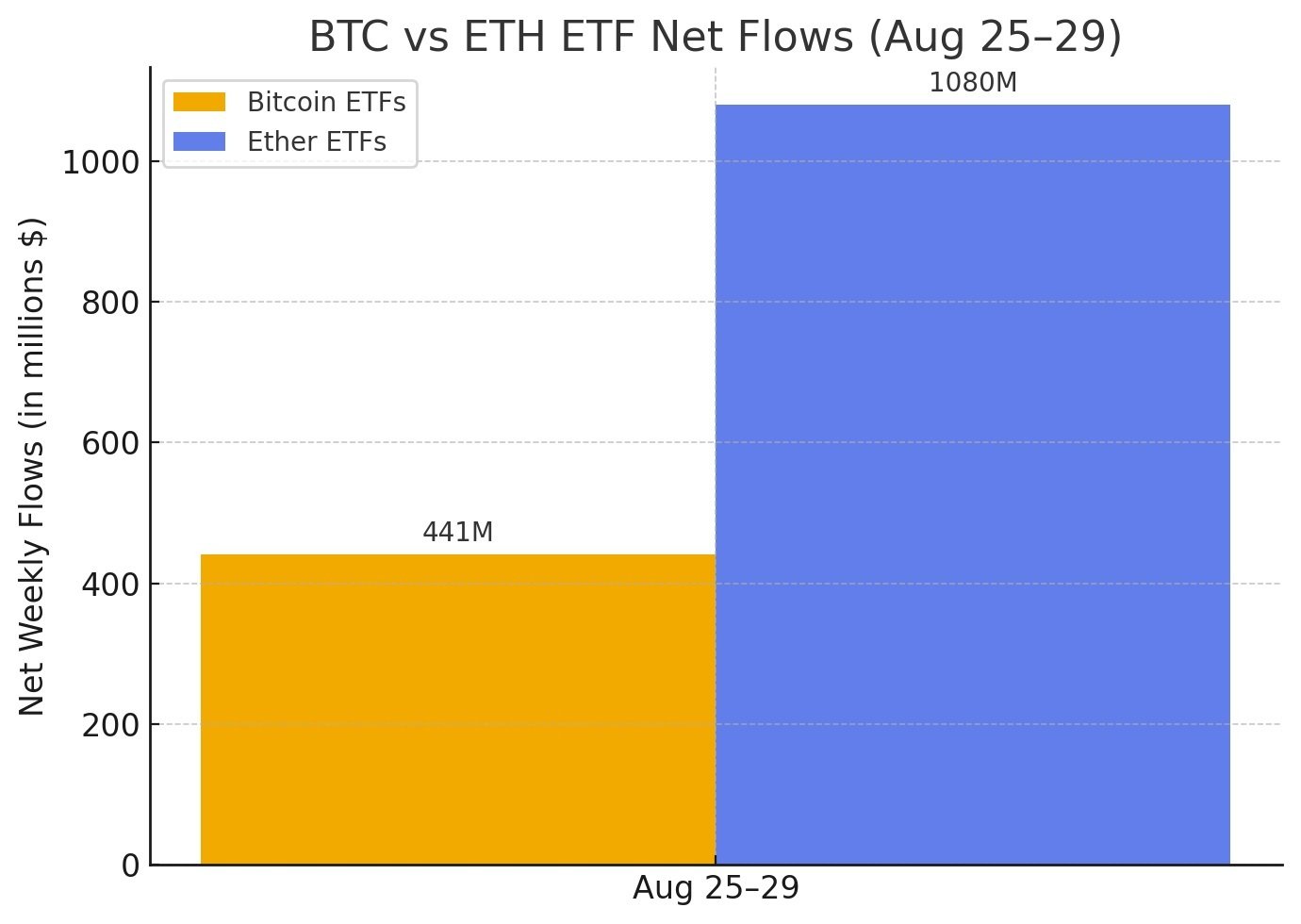

Ether ETFs Power Ahead With $1.08 Billion Weekly Inflows as Bitcoin Funds Add $441 Million

Ether exchange-traded funds (ETFs) surged with $1.08 billion in weekly inflows, while bitcoin ETFs added $441 million, marking a bullish week for crypto funds despite a Friday pullback. Institutional demand, led by Blackrock’s products, remained the key driver.

Crypto ETFs Close Strong With ETH Dominating Weekly Inflows

Institutional money is still flowing into crypto, and last week’s ETF numbers made it clear. Both bitcoin and ether ETFs closed the August 25–29 stretch in the green, shrugging off Friday’s outflows to lock in a combined $1.52 billion net inflow.

Ether stole the spotlight. ETFs tied to ETH posted $1.08 billion in net inflows, extending a multi-week narrative of rising institutional appetite. The single biggest day came on Tuesday, Aug. 26, when ETH funds drew in $455 million.

Blackrock’s ETHA led with a staggering $968.19 million weekly inflow, followed by Fidelity’s FETH (+$108.98 million) and Grayscale’s Ether Mini Trust (+$54.40 million). Smaller but steady contributions came from 21shares’ TETH (+$7.91 million), Vaneck’s ETHV (+$3.53 million), Bitwise’s ETHW (+$2.52 million), and Invesco’s QETH (+$2.22 million). The only funds ending red were Grayscale’s ETHE (-$46.85 million) and Bitwise’s ETHW (-$15.27 million).

Bitcoin ETFs had a quieter, but still positive, week. Net inflows totaled $441 million, buoyed by a $219 million spike on Monday, Aug. 25. Blackrock’s IBIT was the standout at +$247.94 million, with Ark 21shares’ ARKB (+$78.59 million) and Bitwise’s BITB (+$46.21 million) close behind.

Grayscale’s Bitcoin Mini Trust added $24.12 million, while Fidelity’s FBTC logged a modest +33.43 million. Other contributors included Vaneck’s HODL (+$10.24 million), Invesco’s BTCO (+$6.71 million), Franklin’s EZBC (+$6.48 million), and Wisdomtree’s BTCW (+$2.30 million). Only Grayscale’s GBTC ended red with -15.30 million.

The week wasn’t flawless. Friday’s combined $292 million outflow cooled momentum, but the broader trend is clear: institutions are leaning into crypto ETFs. Ether, in particular, has emerged as the preferred bet, pulling in more than twice the weekly inflows of bitcoin.

With August ending, all eyes now turn to whether this demand carries into September or if Friday’s stumble was a warning sign of cooling appetite.