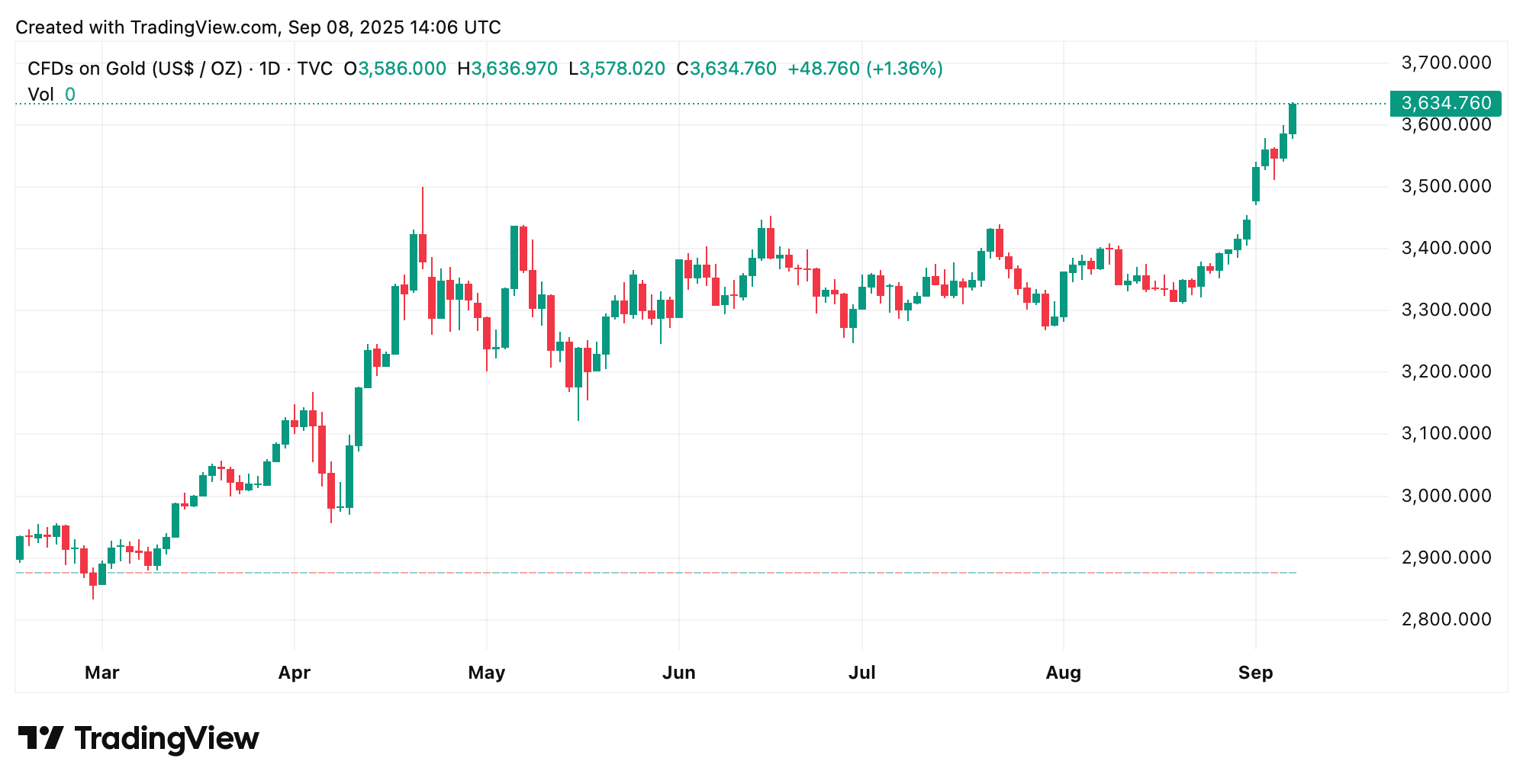

Gold Blasts to $3,637 Lifetime High as Fed-Cut Bets and Weak Dollar Collide

The price of gold set a fresh all-time high on Monday, Sept. 8, reaching $3,637 per ounce. In recent months, the metal has held elevated levels, up about 1% from the prior day and 44% year over year.

Safe-Haven Stampede: Gold Prints New Peak While the Greenback Slips

At 10 a.m. Eastern time Monday, OANDA data via TradingView showed an ounce of fine gold trading at $3,635. At 9:46 a.m., it notched a lifetime peak of $3,637 per ounce. The climb to that mark isn’t happenstance—it reflects a mix of macroeconomic, geopolitical, and financial forces that have kept gold in its classic safe-haven role.

Markets are betting on a U.S. Federal Reserve rate cut, making gold look more appealing than bonds or savings accounts. Persistent uncertainty and sticky inflation have strained the global economy and softened the U.S. dollar, indirectly supporting gold even more so. Additionally, trade tensions tied to President Donald Trump’s aggressive tariffs have steered investors toward gold at an unusual pace.

Meanwhile, the greenback has slipped to multi-month lows, making gold cheaper for international buyers and lifting demand. The metal typically moves opposite the dollar—when the greenback drops, gold tends to climb. Even with a cut expected in about a week, gold bug Peter Schiff says it won’t aid the U.S. economy.

“Lower interest rates won’t ‘help’ the economy this time,” Schiff remarked on X. “The markets will see through the political nature of inappropriate rate cuts despite rising inflation and soaring budget deficits,” he added. The economist continued:

The dollar will sell off and bond yields will rise, pushing up inflation and unemployment.

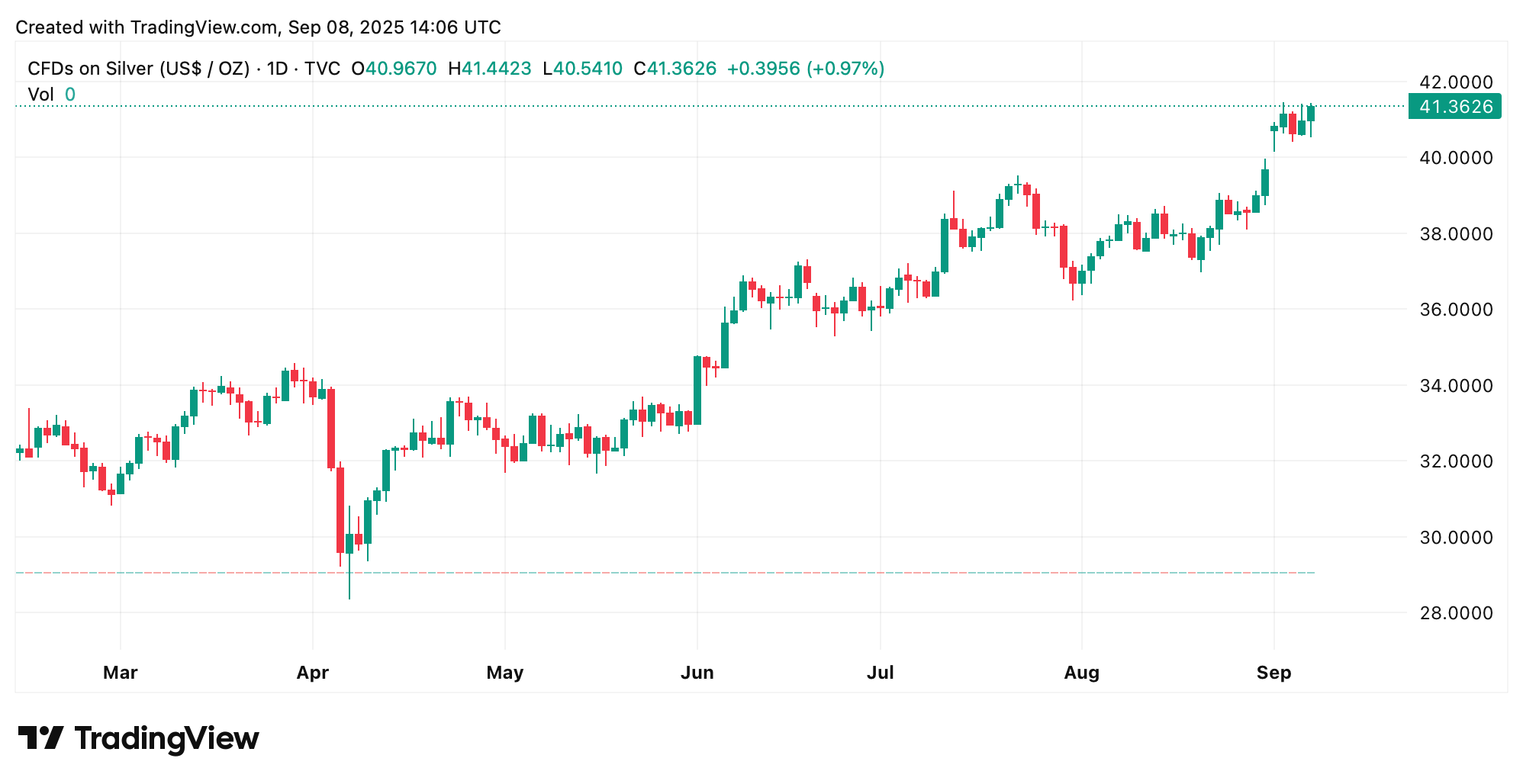

This rally highlights gold’s staying power in turbulent times. Moreover, silver, too, is climbing fast—up about 43% year over year and roughly 1% over the last day. At press time, after an 8.26% rise in the past month, an ounce of fine silver is $41.39 per unit.