Bitcoin Blasts Past $112K—Short Sellers Obliterated in $223M Bloodbath

Bitcoin shattered its previous all-time high on Wednesday, soaring to an unprecedented $112,040 per coin.

Look back the time

Bitcoin’s price is coasting along at $108,832 to $109,067 today, marking continued strength in its ongoing recovery trend. With a market capitalization of $2.16 trillion and a 24-hour trading volume of $23.73 billion, bitcoin fluctuated within a tight intraday range of $107,591 to $109,067.

The 1-hour BTC/USD chart illustrates a short-term recovery following a recent sell-off, underscored by a succession of higher lows and strong green candles. Bitcoin found solid support at $107,471 and is testing near-term resistance around $109,711. Volume surges have accompanied these moves, reinforcing bullish momentum. Traders are finding entry points between $108,000 and $108,500 during minor dips, targeting exits as resistance nears $109,500 to $110,000. This signals a potential for short-term breakouts if buying pressure holds.

On the 4-hour chart, bitcoin appears to be consolidating with a slight bullish tilt. The price is coiling between support at $107,238 and resistance at $110,557. Candle formations from July 5 to July 7 showed market indecision, but the recent attempt to break out signals an underlying upward bias. A retest of $108,000 with robust volume would validate a mid-range long position, while exit levels are identified between $109,800 and $110,500 should momentum fade.

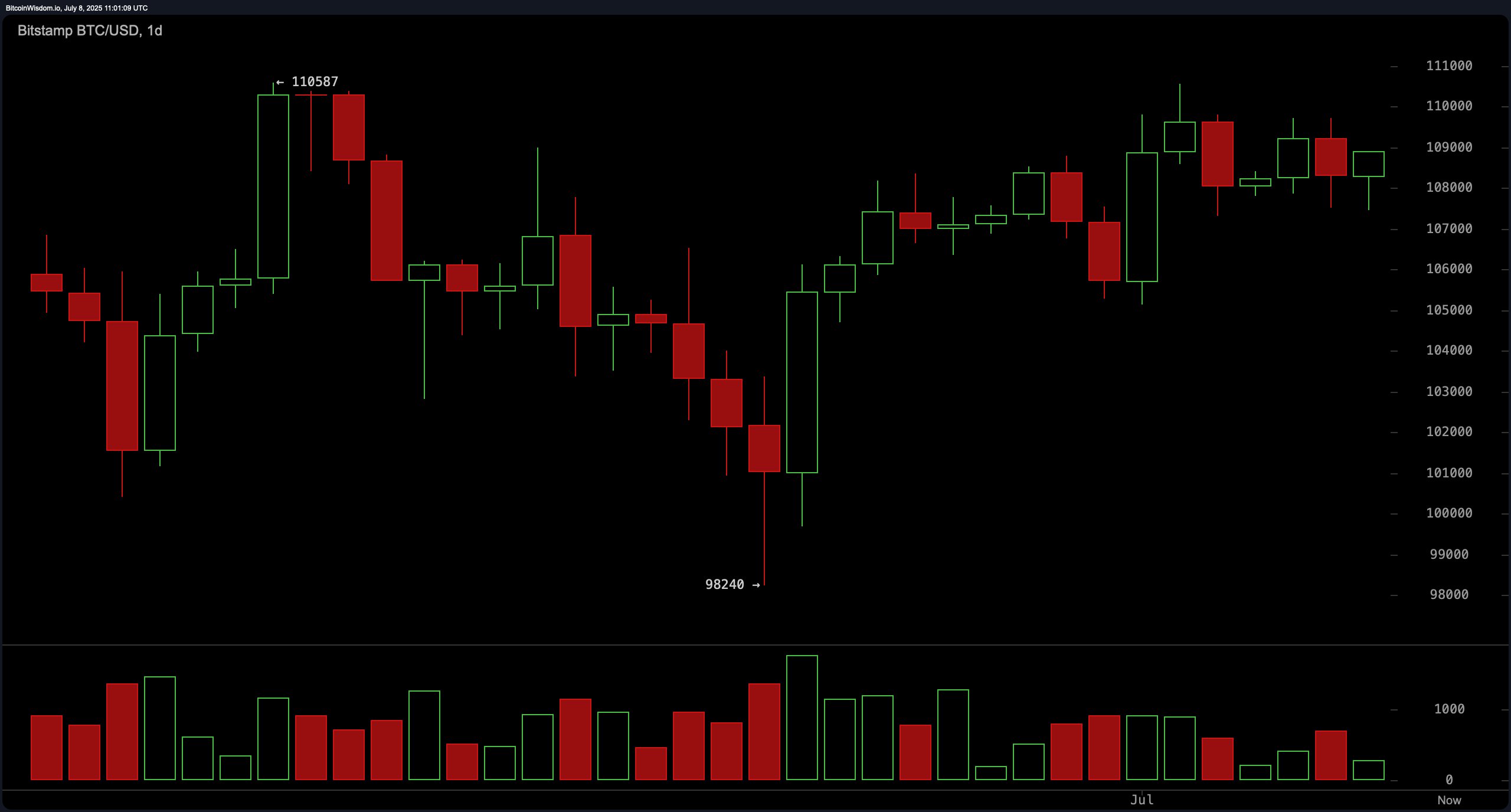

From a macro perspective, the daily chart shows bitcoin recovering from its $98,240 bottom. The trajectory remains upward, albeit choppy, with buyers stepping in near the $104,000 to $105,000 support zone during late June. The key resistance at $110,587 remains unbroken, and traders are closely watching for a sustained move above $108,000 to confirm a bullish continuation. Exiting between $110,000 and $111,000 may offer prudent gains near historical resistance levels.

The cryptocurrency appreciated 3% against the U.S. dollar on July 9, registering a new record on Bitstamp at $112,040. Bitcoin’s market capitalization now rests at $2.221 trillion, accompanied by $28.18 billion in volume exchanged throughout the day. This upward movement nudged the entire digital asset market 3.02% higher, lifting total valuation to $3.47 trillion.

The spike also ignited a cascade of liquidations, triggering $484.72 million in closed positions across derivatives platforms. Of that, $223 million stemmed from bitcoin short sellers liquidated after the asset climbed from the $109K zone to the day’s record peak. As of 4:15 p.m. Eastern time, bitcoin’s price has retreated slightly, now trading at $111,297.