Decoding WhiteFiber’s IPO: Bit Digital’s AI Infrastructure Arm Steps Into the Spotlight

WhiteFiber, Bit Digital’s (BTBT) HPC/AI subsidiary, just launched its IPO under WYFI. I dug into the filings to break down key details and what it means for both companies.

A Look at WhiteFiber’s Initial Public Offering

The following guest post comes from Bitcoinminingstock.io, the one-stop hub for all things bitcoin mining stocks, educational tools, and industry insights. Originally published on July 31, 2025, it was penned by Bitcoinminingstock.io author Cindy Feng.

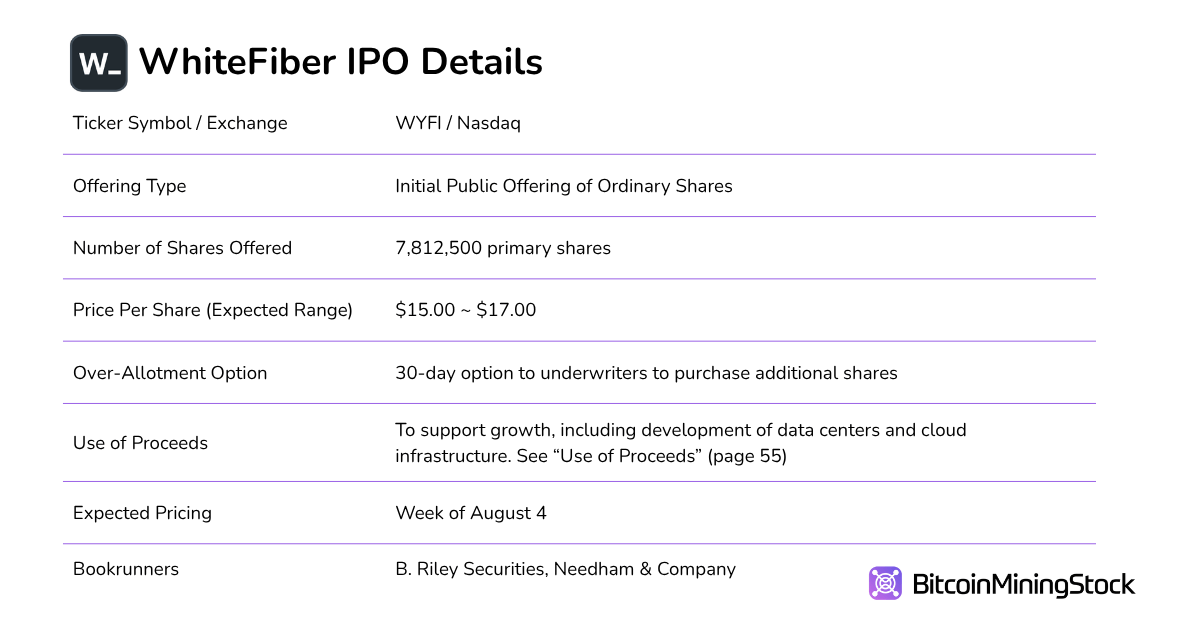

WhiteFiber Inc., the high-performance computing (HPC) and AI infrastructure subsidiary of Bit Digital (NASDAQ: BTBT), has launched its initial public offering. The company is offering 7,812,500 ordinary shares at a proposed price range of $15.00 to $17.00 per share, with underwriters granted a 30-day option to purchase an additional 1,171,875 shares. Upon listing under the ticker WYFI on the Nasdaq Capital Market, WhiteFiber will become a publicly traded provider of AI-focused cloud and data center services.

This public debut is more than a routine capital raise; it’s a deliberate move by Bit Digital to spotlight and monetize its fast-growing AI infrastructure business. The offering comes at a time when the market is rewarding companies tied to AI. Public miners like Core Scientific and IREN are generally appreciated in the capital market. WhiteFiber seems to seek a similar recognition. As I previously covered, Bit Digital’s AI/HPC unit stood out for delivering significant revenue despite having a modest crypto mining footprint.

However, this progress was recently overshadowed by Bit Digital’s pivot from Bitcoin to an Ethereum treasury strategy, a direction not all investors are confident in. As such, WhiteFiber’s IPO can be seen as a strategic step to separate a high-growth infrastructure story from crypto’s volatility.

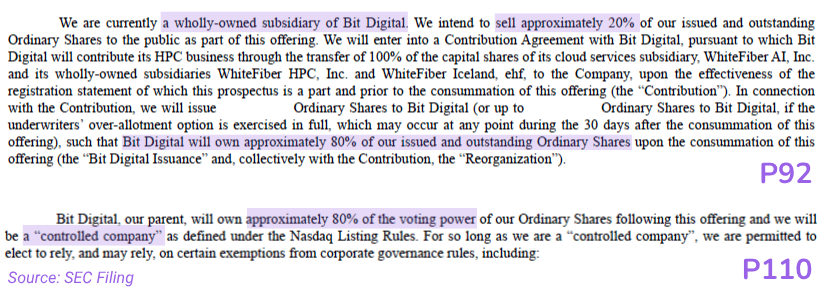

WhiteFiber’s Relationship with Bit Digital: A Strategic Carve-Out

It’s important to note: WhiteFiber is not a spin-off. There will be no share distribution to Bit Digital shareholders. Instead, this is a carve-out IPO where Bit Digital is selling a 20% stake of its AI/HPC business to the public while retaining ~80% ownership and voting control post-offering, qualifying WhiteFiber as a “controlled company” under Nasdaq rules.

This structure allows Bit Digital to maintain exposure to the upside of WhiteFiber’s growth, while giving the latter operational independence and access to capital on its own merits.

What this means for investors: you won’t automatically receive WhiteFiber shares just by holding Bit Digital stock. But Bit Digital’s balance sheet will benefit from any market upsides of WhiteFiber, and the move helps reduce perceived crypto-related risk in WYFI financials.

In terms of leadership, WhiteFiber has a newly assembled team but several key members of Bit Digital’s executives will retain overlapping roles. Additionally, it appoints independent directors with domain expertise. Overall, this structure ensures continuity and strategic alignment, especially during a high-growth phase, but also raises questions about eventual governance independence.

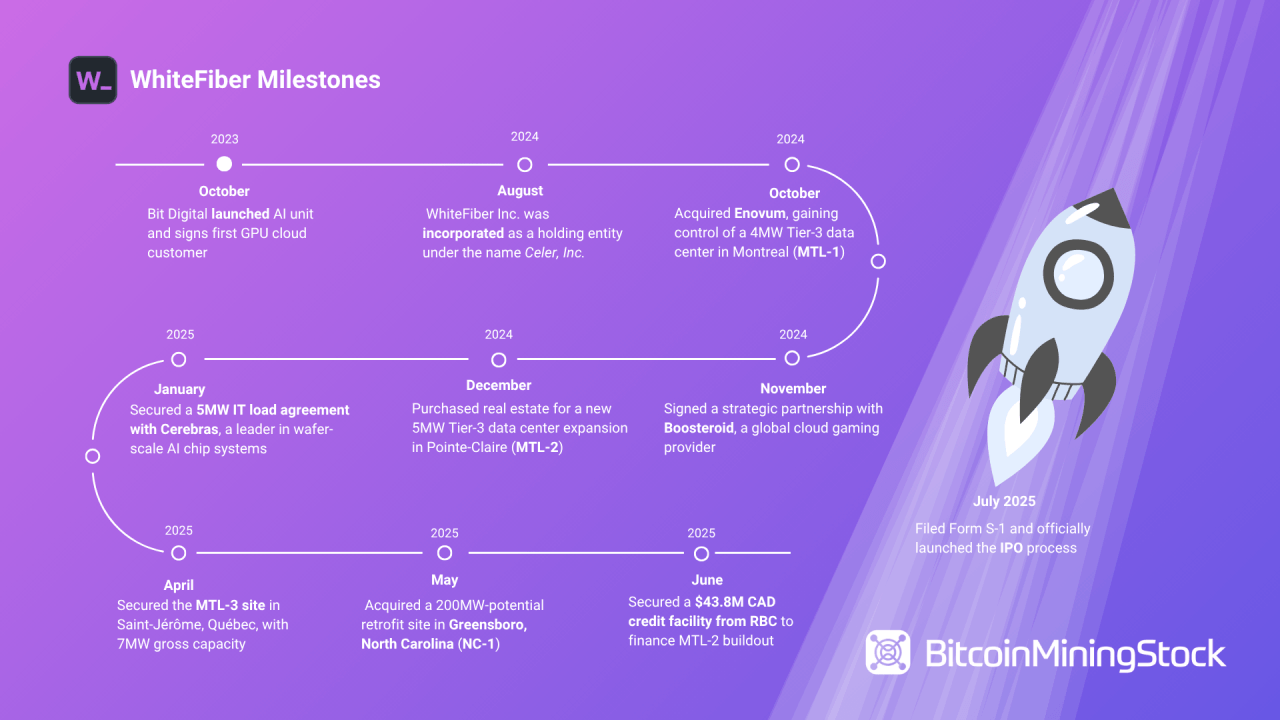

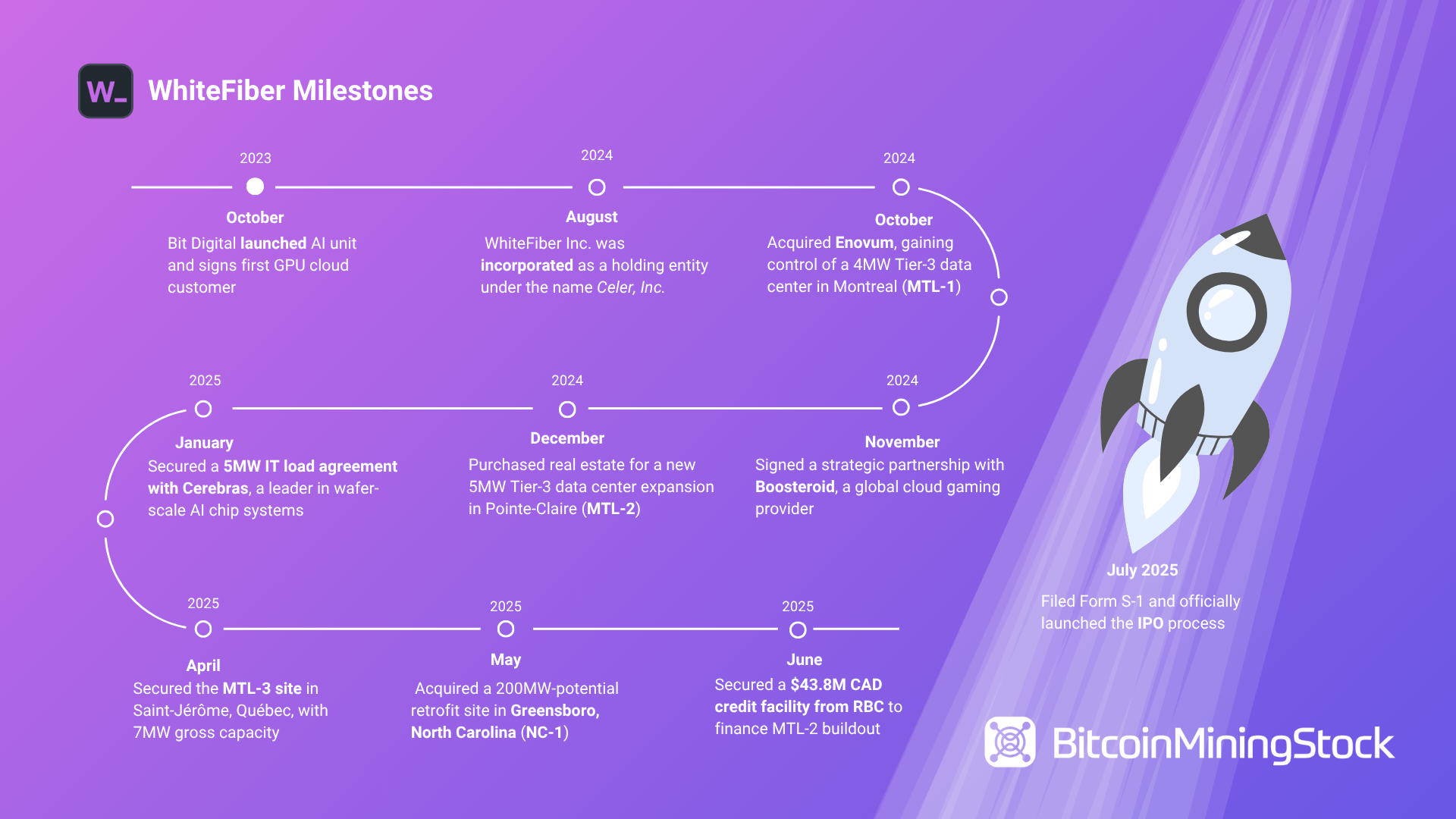

Milestones That Signal Intentional Buildout

WhiteFiber’s timeline stretches back to October 2023, when Bit Digital launched its AI unit and signed its first GPU cloud services customer under the name Bit Digital AI, Inc. The formal incorporation of WhiteFiber as a holding vehicle followed in August 2024, under the name Celer, Inc. Here’s a condensed timeline of strategic developments:

Pieced together, these milestones reflect a company that is rapidly scaling and doing so through strategic partnerships, targeted acquisitions, and secured power agreements. This is not speculative growth. It is calculated and resource-backed.