How Are Projects Moving From IDO to Binance Spot? The Alpha2.0 Effect

Binance Alpha 2.0 is reshaping token launches with explosive trading volumes, strong BSC dominance, and a clear pipeline driving projects from IDO to Binance Spot.

Table of Contents

What is Binance Alpha 2.0?

Explosive Trading Volume on Alpha 2.0

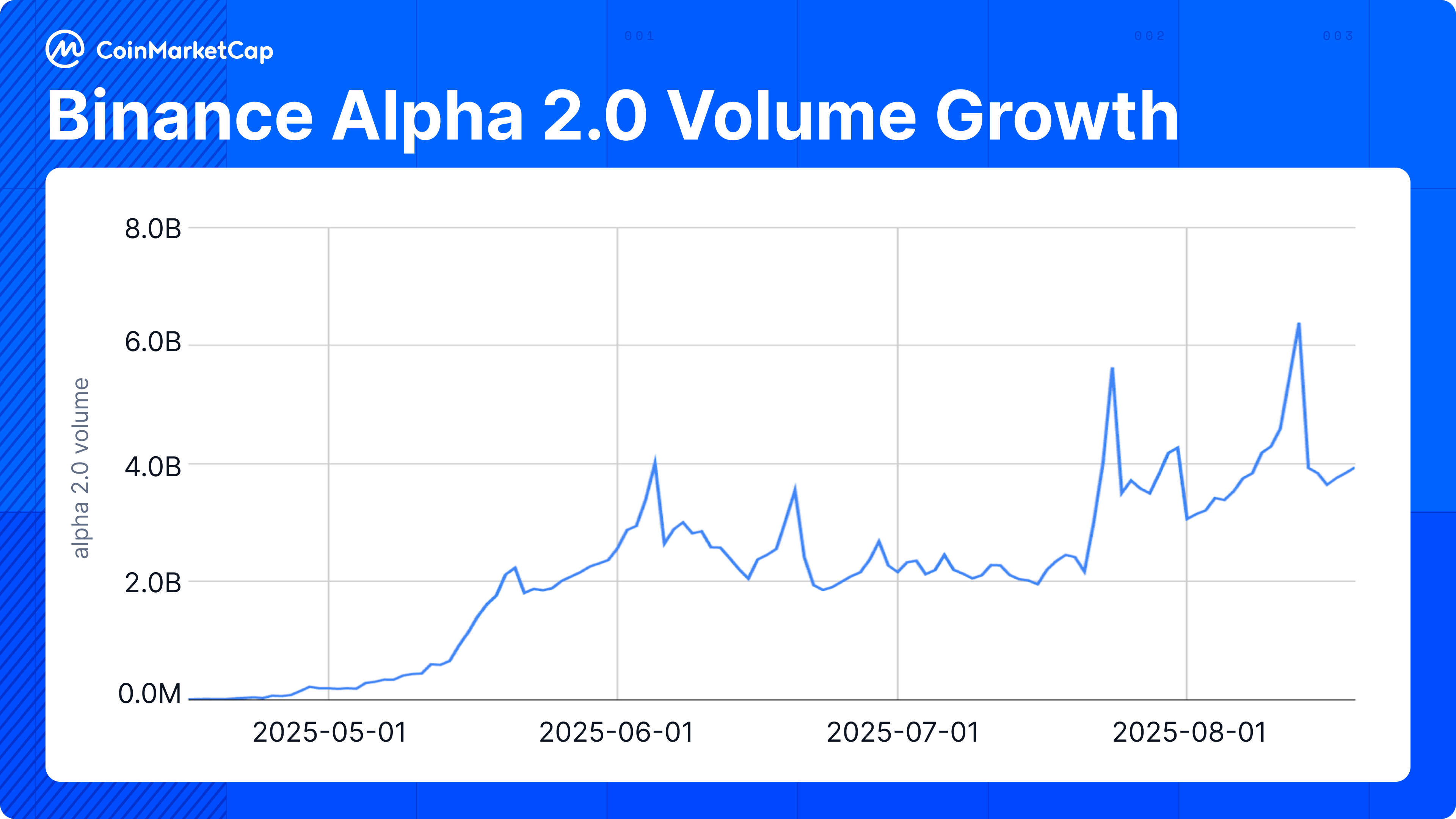

Figure 1: Binance Alpha 2.0 Surges to Multi-Billion Daily Volumes, Rivalling Top Exchanges

Binance Alpha 2.0’s trading activity has been nothing short of explosive. By mid-2025, it has regularly posted multi-billion dollar daily trading volumes, rivalling the world’s top exchanges. Indeed, aside from Binance’s main exchange, Alpha’s daily turnover has recently hit $6bil, outstrips the volume on other top exchanges like OKX, HTX (formerly Huobi) or Coinbase. This remarkable performance highlights how successful Binance’s integration of Alpha has been in capturing liquidity. The activity isn’t just raw numbers either – it signifies engagement from both CEX traders and DeFi users. A Binance report noted Alpha’s volume spiked 223% in a week by drawing in users from both centralized and decentralized realms, pushing BNB Chain’s overall on-chain volume to new highs. In short, Alpha 2.0 has become a major driver of trading activity on BNB Smart Chain and a significant liquidity hub in the crypto market.

The implications are significant:

- For users, high volumes ensure deep liquidity and tighter spreads, reducing slippage during trading.

- For projects, strong turnover provides a credible case to exchanges for further listing consideration.

- For exchanges, Alpha functions as an external filter, supplying projects that have already been stress-tested in live markets.

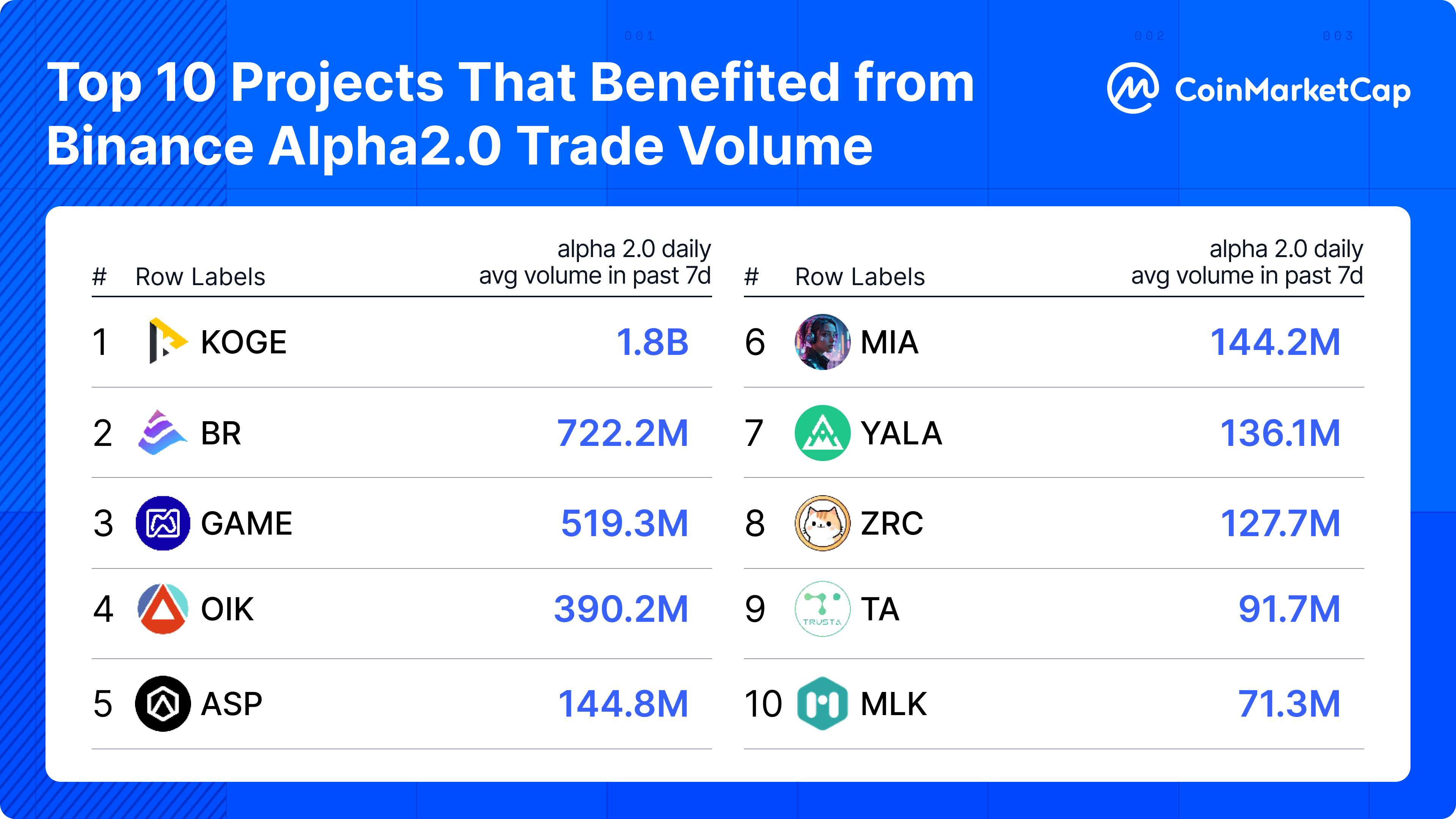

Figure 2: Top 10 Projects That Benefited from Binance Alpha2.0 Trade Volume

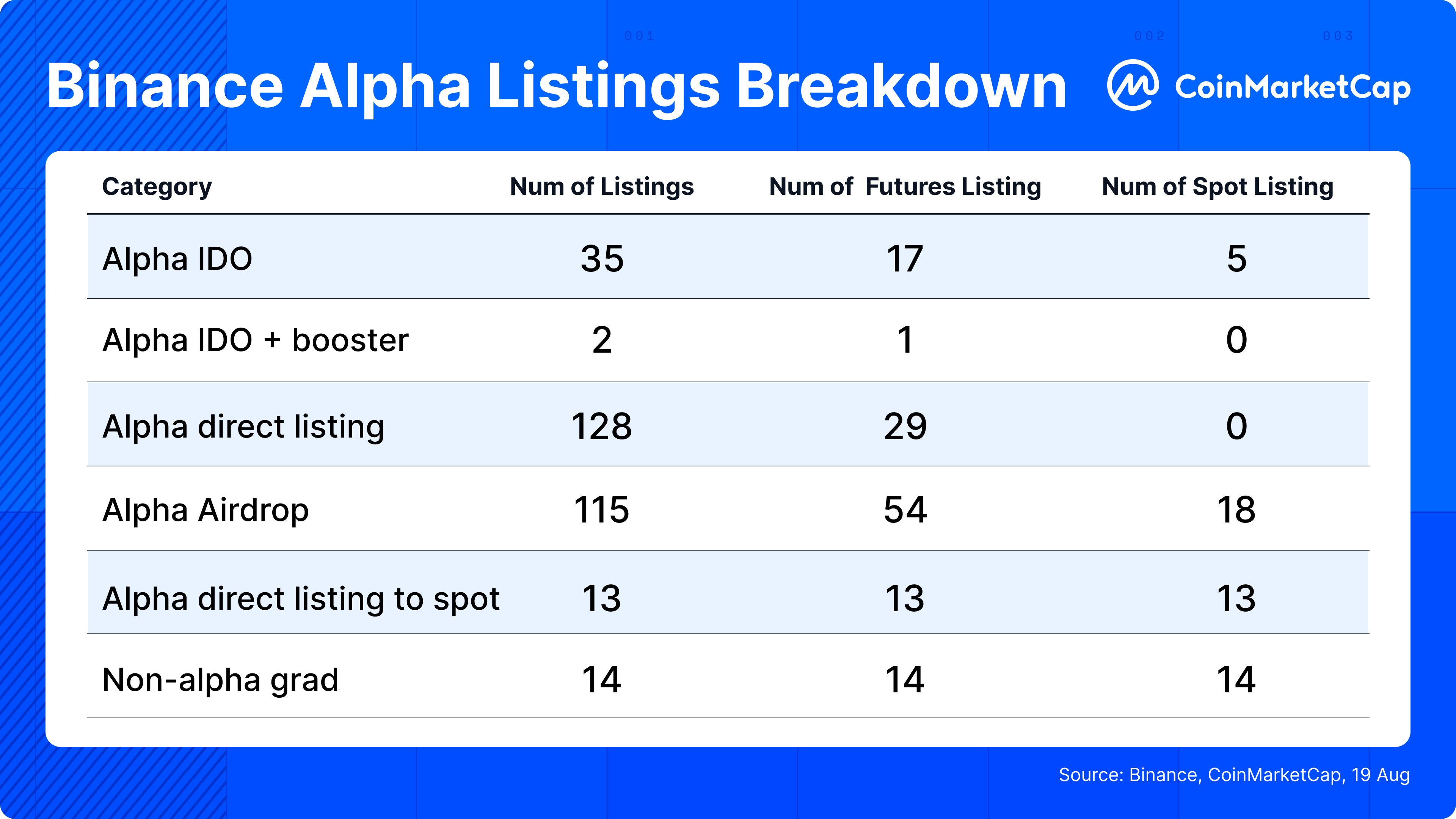

Pipeline of Projects Graduating to Binance Listings

Beyond trading volume, the Binance Alpha 2.0 program has proven to be a launchpad for promising projects.

As of August 2025, Alpha-linked launches have generated 152 projects that went on to secure exchange listings. Among them, 72 progressed to Binance Futures, giving a 47.5% conversion rate from launch to derivatives markets. This relatively high rate reflects the way Alpha concentrates liquidity and trading activity early in a project’s lifecycle—factors that exchanges use as indicators of market readiness.

Meanwhile, 23 projects reached Binance Spot, a 15% progression rate. Although lower in absolute terms, spot listings are generally more selective, requiring a combination of sustained user interest, liquidity depth, and broader market recognition. Binance Alpha projects have reached this threshold at a rate above historical norms for community-driven IDOs suggests that the platform has become a meaningful pipeline for tokens to achieve mainstream exposure.

Within this pipeline, initiatives such as Alpha Airdrops (115 projects) and Alpha IDO or booster campaigns (37 projects) have played a critical role in driving projects from community launches toward high-visibility exchange listings. Together, these results indicate that Alpha has evolved into more than a launch venue; it acts as a sorting mechanism where market forces determine which projects are likely to cross into higher tiers of exchange visibility.

Figure 3: Alpha Listings Breakdown (Total, Futures, Spot)

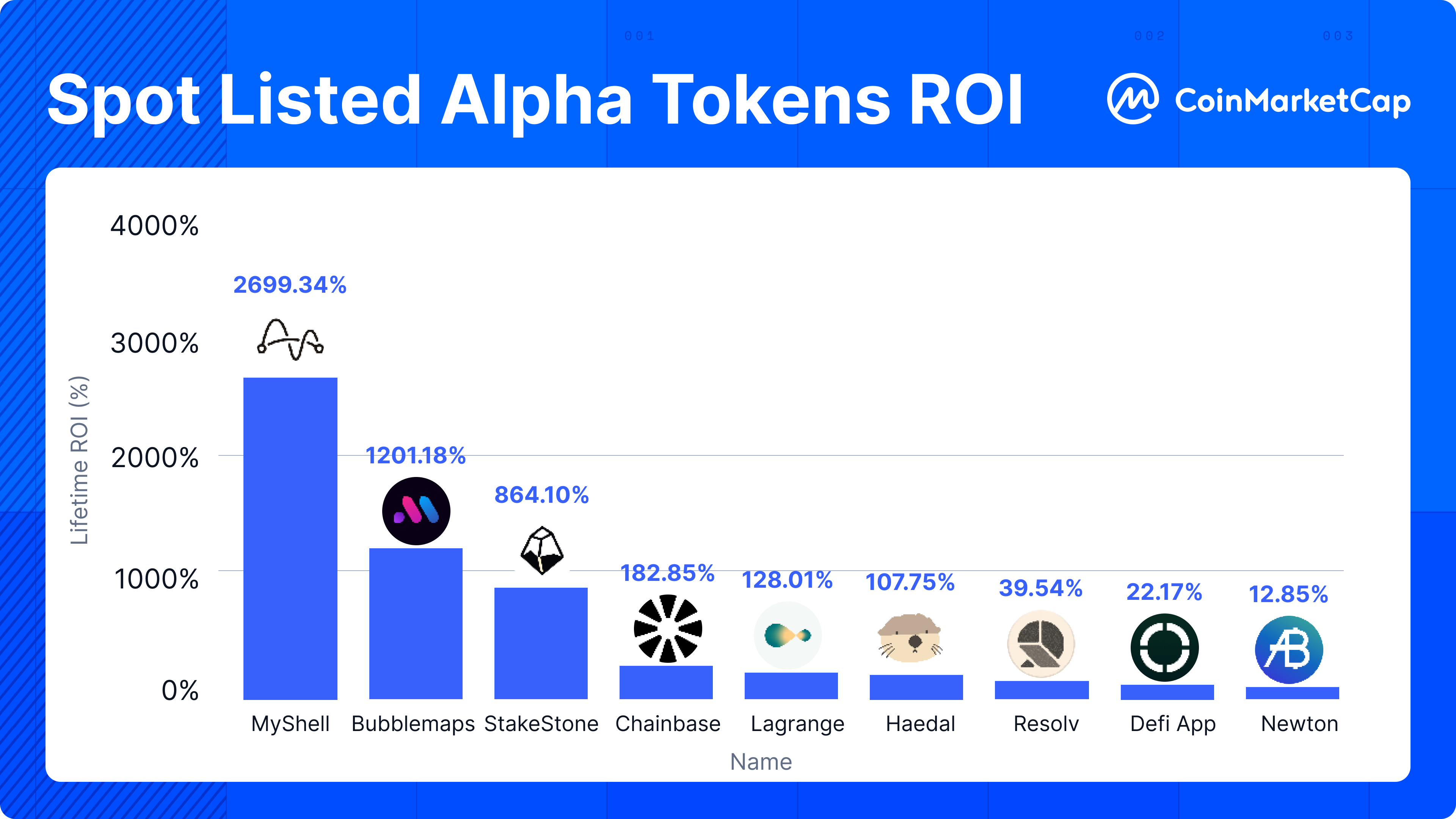

The ROI for Alpha tokens listed on Binance Spot shows a clear long-tail effect, where a few top performers delivered outsized returns. For example, MyShell (2699.34%), Bubblemaps (1201.18%), and StakeStone (864.10%) represent the “head” of the distribution, while the median ROI for all tokens was 128.01%.

BSC Dominance Among Alpha Projects

Another notable aspect of Alpha 2.0’s ecosystem is the predominance of BNB Smart Chain (BSC) projects. Binance’s Alpha initiative has largely centered on BSC as the network of choice for new tokens, aligning with Binance’s broader strategy to boost the BSC ecosystem. Out of the 152 Alpha-launched projects, the vast majority were BSC-based tokens. In fact, approximately 91% of these projects are deployed on BSC, with only a handful on other chains (a few on Ethereum, Base, Sui, Solana, etc., each just 1–3% of the total). This skew highlights that Binance Smart Chain is the backbone for Alpha 2.0’s offerings, leveraging BSC’s low fees and PancakeSwap IDO platform for launching new tokens. It also reflects Binance’s intent to drive activity to its own chain – and it appears to be working, as BSC’s DEX volumes and usage have surged thanks to Alpha’s influx of projects and users.

Conclusion: Alpha 2.0 as a Structural Innovation

In just a short span, Binance Alpha 2.0 has proven to be a resounding success on multiple fronts. Its trading volume has scaled to levels on par with the largest global exchanges, often contributing billions of dollars per day in turnover. This flood of activity underscores how effectively Binance has onboarded users into the Alpha program by bridging CEX convenience with DeFi opportunities. Simultaneously, the Alpha pipeline has yielded dozens of projects that graduated to Binance listings – a testament to the program’s ability to surface quality tokens. With nearly half of Alpha tokens reaching Binance futures, and a significant subset achieving spot listings, Alpha 2.0 has become a reliable feeder of new markets for Binance. Moreover, by focusing on BNB Smart Chain, it has boosted Binance’s own blockchain, driving BSC’s trading volumes to new highs and affirming its position as a leading ecosystem for new projects. By delivering high trading volumes, Alpha provides early validation of demand. By generating measurable progression to futures and spot markets, it demonstrates practical impact. And by anchoring itself in the BSC ecosystem, it positions itself as a strategic pipeline for Binance and other exchanges seeking credible projects.

If the current trajectory continues, Alpha 2.0 could become not just a launchpad, but the de facto liquidity gateway for the next wave of crypto adoption.