SEC Commissioner Crenshaw Rebuffs Statement on Liquid Staking

The staunch crypto critic has once again challenged her colleagues in the SEC’s Division of Corporation Finance on their favorable guidance on liquid staking.

Crenshaw Pushes Back on SEC’s Liquid Staking Guidance

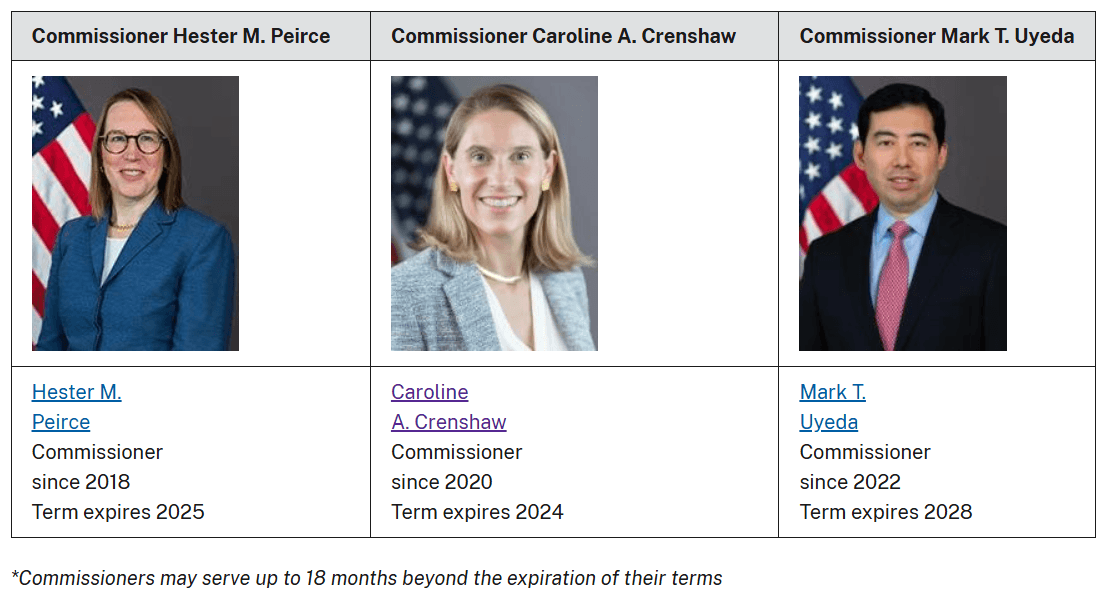

Commissioner Caroline Crenshaw of the U.S. Securities and Exchange Commission (SEC), who Coinbase CEO Brian Armstrong once called “a failure,” has once again lived up to her anti-crypto reputation by issuing a blistering rebuke yesterday, of her colleagues’ “Statement on Certain Liquid Staking Activities,” also published on Wednesday.

Despite being a Democrat, the Harvard graduate was appointed Commissioner by U.S. President Donald Trump during his first term in 2020. A Senate Banking Committee vote to renominate Crenshaw was canceled in late 2024, meaning her term would expire that same year, but according to the SEC’s own website, “Commissioners may serve up to 18 months beyond the expiration of their terms.”

Perhaps Crenshaw’s sharp critique is a final attempt to discredit an industry that has campaigned heavily to have her removed from the commission. In her statement, Crenshaw claims the Division of Corporation Finance’s guidance provides no clarity at all but rather, “only muddies the waters.” She characterizes her co-workers’ legal analysis as “a wobbly wall of facts without an anchor in industry reality,” riddled with “plentiful assumptions.”

“Given its unsupported factual assumptions and circumscribed legal analysis, the Liquid Staking Statement should provide little comfort to entities engaged in liquid staking,” Crenshaw writes, before ending with a pointed warning. “For those entities whose liquid staking programs deviate in any respect from the soaring wall of factual assumptions erected in the Liquid Staking Statement, the message should be clear: Caveat liquid staker.”