Setting Stop-Loss and Take-Profit Orders Effectively

In the realm of trading, whether in stocks, forex, or cryptocurrencies, effective risk management plays a crucial role in ensuring long-term profitability. One of the key tools traders utilize for risk management is the stop-loss and take-profit order. In this in-depth article, we will explore what stop-loss and take-profit orders are, their importance, how to set them effectively, and strategies to incorporate them into your trading approach.

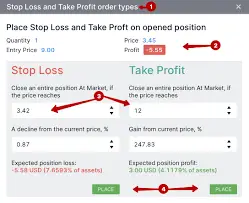

Understanding Stop-Loss and Take-Profit Orders

What is a Stop-Loss Order?

A stop-loss order is a predefined price point at which a trader will exit a losing position. The main objective is to minimize losses by selling the asset automatically once it reaches the specified price. For instance, if you purchase a stock at $50 and set a stop-loss order at $45, your shares will automatically be sold if the price falls to $45, thereby limiting your loss to $5 per share.

What is a Take-Profit Order?

Conversely, a take-profit order is set to secure gains by automatically selling an asset when it reaches a specified profit level. Using the same stock example, if you buy the stock at $50 and set a take-profit order at $60, your shares will automatically be sold at $60, securing a profit of $10 per share.

Why Are Stop-Loss and Take-Profit Orders Important?

- Risk Management: These orders are essential for managing risk and preserving capital. They help prevent emotional decision-making during market volatility.

- Discipline: Setting these orders enforces a trading discipline. They compel traders to have a clear strategy and stick to it, even in fast-moving markets.

- Automation: By automating your exit strategy, you can focus on analyzing new trading opportunities rather than monitoring existing positions constantly.

- Maximizing Profits: Take-profit orders ensure you lock in profits at predetermined levels, preventing you from holding onto a position for too long and risking the gains you have made.

How to Set Stop-Loss and Take-Profit Orders Effectively

Setting these orders involves a balance of analyzing market trends, understanding your risk tolerance, and implementing sound trading strategies. Here’s a guide to setting them up effectively:

1. Identify Key Support and Resistance Levels

Support and resistance levels in price charts act as psychological barriers for price movements. Traders should consider placing stop-loss orders slightly below support levels and take-profit orders just below resistance levels. By doing this, you increase the probability of your orders being triggered under favorable market conditions.

- Support Level Example: If a stock has consistently bounced back when it hits $45, consider placing your stop-loss there.

- Resistance Level Example: If a stock frequently gets rejected at $60, set your take-profit just below this level at $59.

2. Calculate Your Risk-Reward Ratio

A favorable risk-reward ratio is crucial in maximizing profitability. Generally, traders aim for a ratio of at least 1:2, meaning for every dollar risked, you aim to gain two. For instance, if you set your stop-loss $5 below the entry point, your take-profit should be at least $10 above it.

3. Use Volatility Indicators

Market volatility can help determine where to place your stop-loss and take-profit orders. If the market is particularly volatile, consider setting wider stops to avoid being prematurely stopped out due to price fluctuations. Conversely, in a stable market, tighter stops can secure your position efficiently.

- Average True Range (ATR): An indicator that gauges market volatility, enabling traders to compute appropriate stop-loss distances based on recent price fluctuations.

4. Adjust to Market Conditions

While establishing initial orders is critical, ongoing adjustments based on market conditions can enhance profitability:

- If a stock trends upward, consider moving your stop-loss to a break-even point or a trailing stop to lock in profits.

- Conversely, in sideways markets, you might need to reevaluate your exit strategies to maintain favorable risk-reward dynamics.

Types of Stop-Loss and Take-Profit Orders

1. Fixed Stop-Loss and Take-Profit Orders

These orders are set at predefined levels (e.g., 10% below the entry price for stop-loss, 20% above for take-profit). They are simple to implement but may not account for market volatility.

2. Trailing Stop-Loss Orders

A trailing stop-loss moves with the market price, maintaining a set percentage or dollar amount below the market’s highest price. This allows you to capture profits while still offering downside protection.

- Example: If you initially set a trailing stop-loss of 10% and the stock’s price moves from $50 to $70, the new trailing stop-loss adjusts to $63, allowing for continued gain protection as the stock rises.

3. OCO (One Cancels Other) Orders

An OCO order combines both a stop-loss and take-profit in one order. When one order is executed, the other is automatically canceled, allowing traders to manage their exits without having to monitor continuously.

Common Mistakes to Avoid

- Setting Orders too Tight: Placing stop-loss orders too close to entry prices may lead to premature exits during routine volatility. Consider wider protections based on sound market analysis.

- Ignoring Market Conditions: Failing to recalibrate stop-loss and take-profit levels according to volatility can undermine their effectiveness.

- Emotional Decision-Making: Traders sometimes alter their stop-loss or take-profit orders based on emotions rather than data. Sticking to your defined plan is paramount for long-term success.

- Not Testing Strategies: Implementing stop-loss and take-profit orders should follow thorough backtesting and forward testing in demo accounts to understand how they perform in real-time.

Real-World Examples of Stop-Loss and Take-Profit Orders

- Case Study 1: A trader buys 100 shares of a stock at $50, setting a stop-loss at $47 and a take-profit at $60. If the stock drops to $47, the shares are sold, limiting the loss to $3 per share. Conversely, if the stock rises to $60, the take-profit triggers, securing a $10 profit.

- Case Study 2: A trader uses a trailing stop-loss on a cryptocurrency purchase for $100 at a 10% trail. As the price increases to $150, the trailing stop-loss adjusts to $135, capturing gains while maintaining lower-risk exposure.

Conclusion

Setting stop-loss and take-profit orders effectively is an essential skill for any trader. By understanding market dynamics, implementing sound strategies, and managing risks quantitatively, traders can significantly enhance their performance and mitigate unwanted losses. Remember that the path of trading is not just about maximizing profits; it’s about ensuring consistent growth and sustainability in your trading journey.

For more insights into trading strategies and market analysis, visit My Website.

—

With this comprehensive guide, traders of every skill level can advance their understanding and application of stop-loss and take-profit strategies, empowering them to make informed and strategic decisions in the ever-evolving world of financial markets.