Solana News: SEC Greenlights LSTs, Seeker Reviews Come In

Solana held its ground and closed the week with modest gains, while its ecosystem grew by 8% to claim a market cap above $250 billion.

Table of Contents

Bonk slipped following corporate treasury developments, but there’s been good news on the regulatory front.

Market Overview

That pullback rippled through the altcoin market, undoing much of the week’s earlier momentum. And there was definitely some momentum!

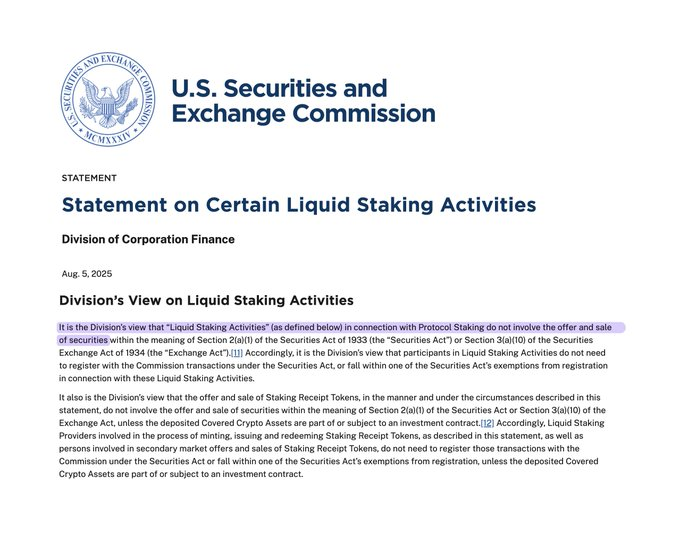

It was a huge week for Solana as the SEC finally declared on Aug. 5 that liquid staking tokens (LSTs) were not subject to securities laws in the U.S. That’s what we call regulatory clarity, kids, and it matters.

There’s one caveat, though: it’s only as long as the underlying asset (in this case, Solana) is not considered a security. With Solana ETFs on the horizon and Solana maxis in the government, this scenario seems very unlikely for the next few years, at least.

OG oracle Chainlink was one of the top gainers after teaming up with Intercontinental Exchange, parent of the New York Stock Exchange, to bring forex and precious metals data on-chain. ICE’s global market feeds will now support over 2,000 DApps and financial institutions in tokenized markets.

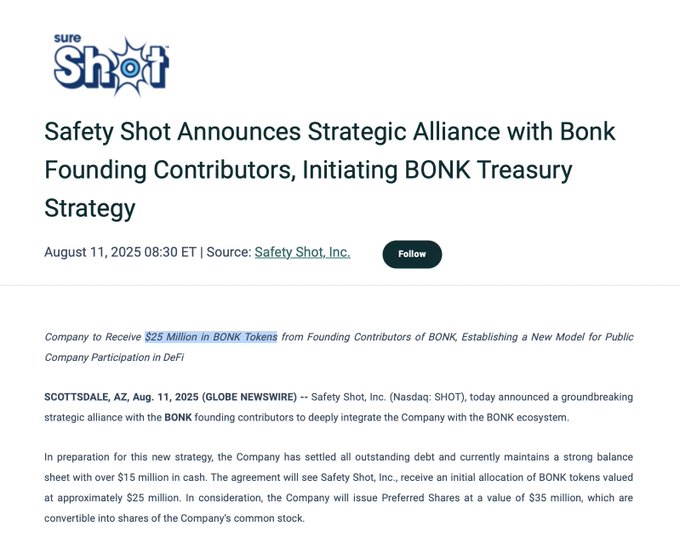

The growing corporate treasury trend is now spilling into Solana’s wider network. Nasdaq-listed Safety Shot has entered a strategic alliance with Bonk’s founding contributors to receive BONK tokens valued at $25 million.

Let’s go over this week’s most important headlines in SolanaLand.

Solana’s Performance

SOL was within touching distance of $190 but pulled back to $175. This minimized its week-on-week gains to 5%.

Could Hong Kong’s approval of

L1 Ranking Update

Solana’s total value locked has climbed to $10.24 billion after the recent rally, creating a clear gap over BNB in third place.

DeFi

Solana’s DEX trading volume fell 5% this week, yet monthly totals still crossed the $100 billion mark.

After a stretch of slower activity, Pump.fun has returned to the lead among meme coin launchpads, topping key metrics including revenue, token launches, and active addresses as they poured liquidity into the sector with the Glass Full Foundation boost.

Biggest Winners & Losers

Top Performers

- Bio Protocol (BIO): +115.85%

- Lido DAO (LDO): +62.55%

- WhiteRock (WHITE): +59.04%

- TROLL (TROLL): +53.77%

- ChainLink (LINK): +29.02%

Biggest Losers

- Fartcoin (FARTCOIN): -14.46%

- Useless Coin (USELESS): -13.95%

- Alchemist AI (ALCH): -8.96%

- Gigachad (GIGA): -6.06%

- Bonk (BONK): -3.64%

Latest Solana News

Solana Seeker Delivers Mid-Range Specs With Premium Touch

Axiom Sets Solana Revenue Record

Kamino’s Season 4 Rewards Spark Utility Debate

What You Can Do Now

- Participate in Kamino Finance’s Season 4 incentives program for a share of $5.1 million in KMNO rewards.

- Track corporate treasury moves as companies channel capital into Solana’s expanding ecosystem.

- Monitor portfolio performance as tokens across the Solana ecosystem post fresh gains.