TeraWulf’s Multi-Billion Dollar HPC Deal Backstopped by Google – A Blueprint for Future Hyperscaler Deals

Google is backing $3.2B for TeraWulf’s HPC hosting deal with Fluidstack and could end up owning ~14% of the company. Will more hyperscalers turn to Bitcoin miners for their energy and infrastructure needs?

TeraWulf’s New HPC Deal

The following guest post comes from Bitcoinminingstock.io, the one-stop hub for all things bitcoin mining stocks, educational tools, and industry insights. Originally published on Aug. 22, 2025, it was penned by Bitcoinminingstock.io author Cindy Feng.

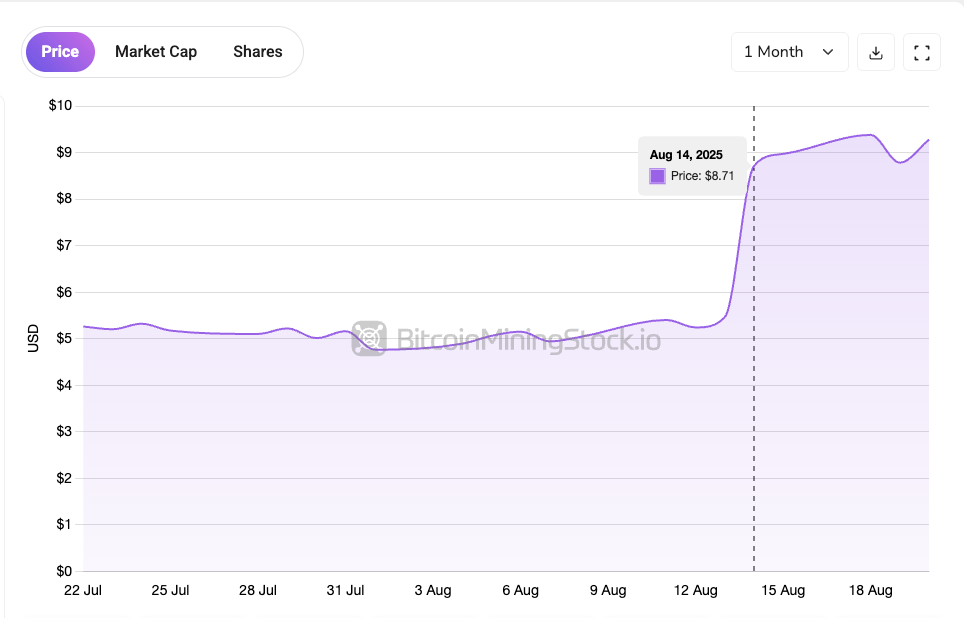

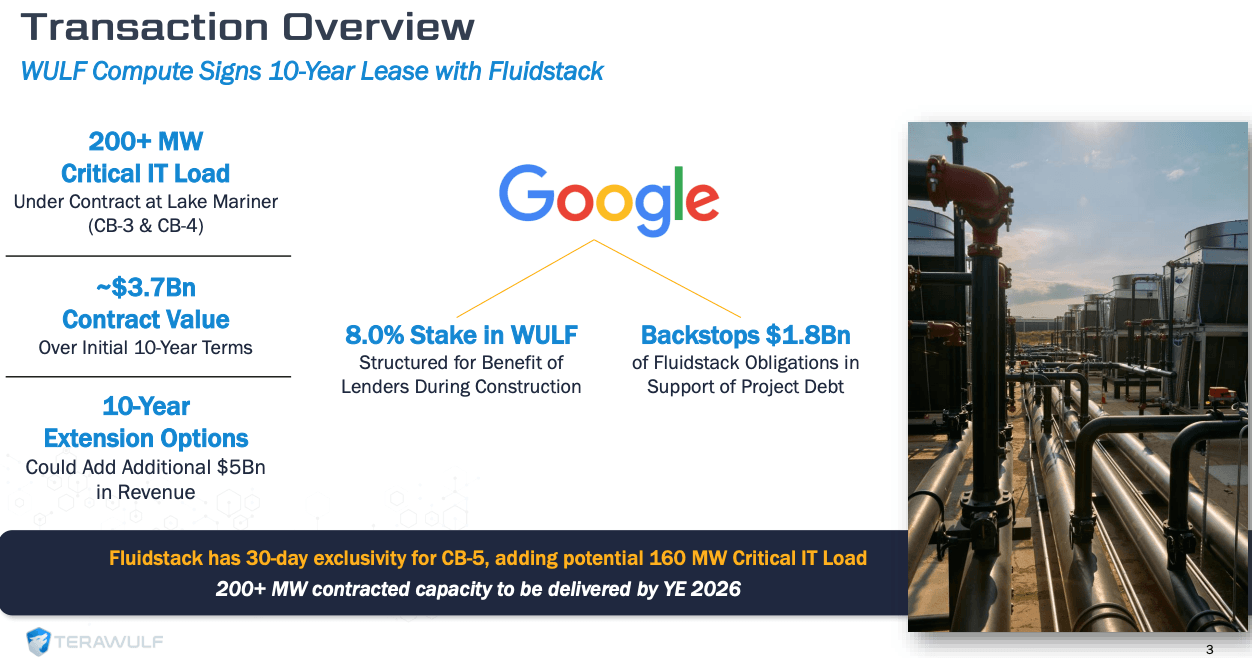

Another major HPC deal among Bitcoin miners is now confirmed. Like Core Scientific’s agreement with CoreWeave in 2024, TeraWulf’s recent announcement has drawn significant attention from investors that sent its stock price up ~60%. Obviously, the projected multi-billion-dollar revenue is the major highlight, but the involvement of Google is like the cherry on top. In this case, Google has backstopped $3.2 billion for the deal and may hold up to 14% of TeraWulf through warrants. This is the first time a major hyperscaler has entered such an agreement with a Bitcoin miner. Though not as a direct customer or lessee, it validates a long-held speculation: hyperscalers are eyeing Bitcoin miners, recognizing their power access and data center infrastructure.

What makes TeraWulf’s deal more exciting is that it outlines a repeatable blueprint for other public miners, since some peers have even larger power pipelines and infrastructure. In this post, I’ll break down key aspects of the deal and share some thoughts to help evaluate future hyperscaler partnerships in Bitcoin mining.

TeraWulf x Fluidstack: $6.7B in Contracted Revenue with Upside to $16B

TeraWulf first announced a 10-year HPC hosting agreement with Fluidstack on August 14, 2025. The agreement covers over 200 MW of infrastructure capacity at the company’s Lake Mariner facility in New York. It is expected to generate $3.7 billion in contracted revenue over the initial term, with a potential to reach $8.7 billion should contract extensions be exercised.